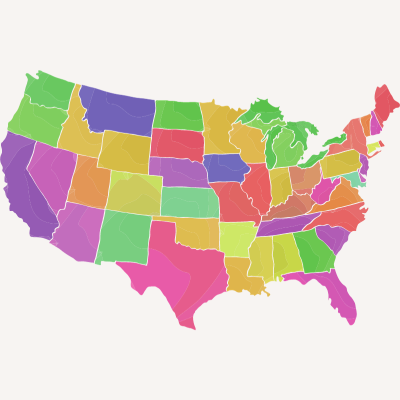

As the world continues to globalize, the traditional workplace is undergoing massive changes. One of the major shifts is the trend toward remote work, which has allowed many workers to explore foreign lands while still able to live the American dream.

The advent of the digital age has made it possible for employees to work from anywhere in the world, leading to an increasing number of professionals seeking employment opportunities with US companies while living abroad.

This article will delve into the benefits of this work arrangement, visa requirements, tax implications, potential challenges, and cultural considerations.

Advantages of Working for a US Company Abroad

Working for a US company that has affiliate offices in another country comes with many advantages. First, you get the opportunity to gain international work experience, which can significantly boost your career profile. You also get to enjoy the benefits of a diverse cultural experience and the opportunity to learn a new language.

Working abroad can be rewarding financially as well. In many cases, US companies offer competitive salaries and benefits, potentially higher than what you would earn in your home country. Depending on your country, the cost of living might be lower, allowing you to save more money and build a good financial standing.

Moreover, you’ll be able to expand your network of professional connections on a global scale. The exposure to different work cultures and practices can give you a fresh perspective and innovative ideas, which can contribute to your professional growth.

Visa Requirements

When it comes to working for a US company abroad, understanding visa requirements is crucial. Each country has its set of rules, and failing to understand what’s administratively needed of you as a foreign visitor may even end your journey before it even begins.

Short-Term Visas

Short-term visas are typically valid for stays of up to 90 days and are intended for business travelers, conference attendees, and other short-term visitors. The specific requirements for short-term visas vary depending on the country, but some common requirements include:

- A valid passport

- A completed visa application form

- Evidence of financial support

- Proof of onward travel

- Travel Insurance

- Proof of payment of fees

Long-Term Visas

For long-term work stays, foreign nationals will need to apply for a work visa. There are a number of different types of work visas, each with its own requirements. Some of the most common types of work visas for foreign nationals working for US companies abroad include:

- General Skilled Migration Visas: These visas are for foreign nationals who have the skills and qualifications that are in demand in the country where they want to work, and who are able to meet certain points-based criteria.

- Employer-Sponsored Work Visas: These visas are for foreign nationals who have been offered a job in the country where they want to work. The employer must be willing to sponsor the foreign national for a visa.

- Occupation-Specific Work Visas: These visas are for foreign nationals who are working in a particular occupation that is in demand in the country where they want to work. Examples of occupation-specific work visas include IT Visas, Healthcare Visas, Engineering Visas, and Teacher Visas.

- Entrepreneur Visas: These visas are for foreign nationals who want to start a business in the country where they want to work.

Additional Considerations

In addition to a work visa, foreign nationals may also need to obtain a work permit from the local government in the country where they’ll be working. The qualifying requirements for a work permit are different in each country, so make sure to find out what they are beforehand.

Tax Implications

Working for a US company abroad has tax implications that you need to consider. Trying to figure out the laws around US taxation can be complicated, especially for those living abroad. As a US citizen or permanent resident, you’re required to file a US tax return regardless of where you live.

If you are a non-US citizen, your tax obligations will depend on your tax residency status, which is determined by your physical presence in the US and your visa status. It’s best to consult a tax professional so you can better understand your tax obligations.

Potential Challenges and Overcoming Obstacles

There’s no denying the benefits of working for a US company abroad, but we must also acknowledge the potential challenges. These might include dealing with time zone differences, language barriers, and cultural differences.

To overcome these obstacles, it’s important to develop good communication skills, be open-minded, and try to understand and respect the local culture. Don’t stay in your own bubble; break out and explore the local riches.

Cultural Considerations

When working for a US company abroad, understanding the cultural nuances of the country you’re in is vital. This will not only help you fit in and adapt quickly but can also contribute to your professional success.

For instance, business practices, communication styles, and work ethics vary significantly from one country to another, and understanding these differences will help you avoid misunderstandings and foster positive relationships with your colleagues and clients. It’s a sign of respect and will show your local colleagues and superiors that you’re sincere in adjusting to the local culture.

Concluding Thoughts

Spending time working for a US company abroad can be a rewarding and enriching experience. It offers numerous benefits, including the opportunity to gain international work experience, earn a competitive salary, and broaden your cultural horizon.

With proper planning and preparation, you can successfully navigate these challenges and make the most of your international work experience.